JPMorgan Chase announced first-quarter results Friday morning, posting earnings of $2.37 a share. Analysts had expected earnings of $2.28.

The beat was driven by gains across every key business line, with higher interest rates benefitting most of the bank’s businesses. Here are the key numbers:

- Revenue: $27.9 billion, up 10% from last year.

- Adjusted net income: $8.7 billion, up 35% from last year.

- Adjustments: The results included a $505 million gain “related to the adoption of new recognition and measurement accounting guidance for certain equity investments previously held at cost.” That added $0.11 a share to earnings.

- Consumer and community banking: Net income increased 67% to $3.3 billion, on revenue of $12.6 billion, as the bank benefitted from higher rates.

- Corporate and investment banking: Net income was up 23% to $4 billion, on revenue of $10.5 billion. That was in part driven by accounting adjustments in the markets business. Excluding those gains, markets revenue was up 7%. Banking revenue fell slightly, down 3%.

- Commercial banking: Net income was up 28% to $1 billion, driven by higher net interest income.

- Asset and wealth management: Net income was $770 million, up 100% from a weak period a year earlier.

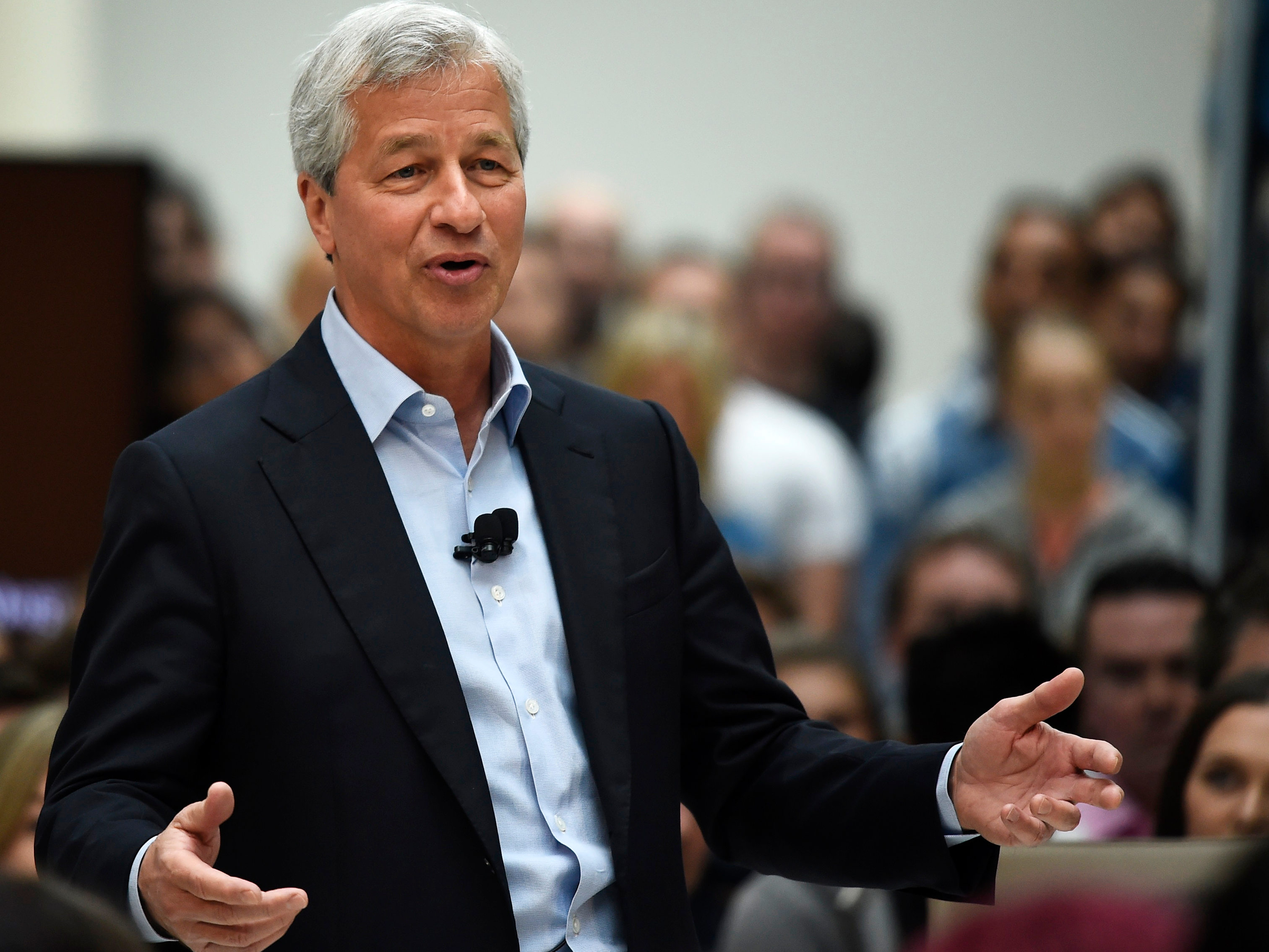

“2018 is off to a good start with our businesses performing well across the board, driving strong top-line growth and building on the momentum from last year,” JPMorgan CEO Jamie Dimon said in a statement.

The fourth-quarter of 2017, by comparison, was noisy and uneven thanks in part to the new tax law, which caused many banks to book one-time losses on repatriated cash and deferred tax assets that declined in value.

JPMorgan took a $2.4 billion hit from the new law last quarter.